E&S News

Cosm Partners With Cosmic Picture to Expand its Premium Media Program for Flexible Planetarium Programming

Premium Media Program participants receive exclusive access to a growing selection of immersive films on a regular basis, with the option to select two newly added productions by Cosmic Picture, expanding upon 40+ award-winning fulldome shows available Cosm Studios is...

Arizona Science Center Partners with Cosm to Reimagine Dorrance Planetarium into Next-Generation 8K+ LED Dome

Marking Europe’s first-ever LED dome, Prague Planetarium will become the world’s most modern planetarium boasting the first and only LED dome of its size in a planetarium February 27, 2024 (Phoenix, AZ and Los Angeles, CA) – Arizona Science Center, Arizona’s premier...

Prague Planetarium Sets New Standard for Planetarium Dome Technology & Unveils Europe’s First LED Dome, Powered by Cosm Technology

Marking Europe’s first-ever LED dome, Prague Planetarium will become the world’s most modern planetarium boasting the first and only LED dome of its size in a planetarium January 10, 2024 (Prague, Czech Republic and Los Angeles, CA) – Prague Planetarium, one of the...

Cosm celebrates the 100th anniversary of planetariums and releases outlook on the future

2023 marked the 100th anniversary of the world's first planetarium projector. As the world’s original immersive experience, the invention of the planetarium enabled the public to step into new worlds and experience the captivating surroundings of the starry night sky,...

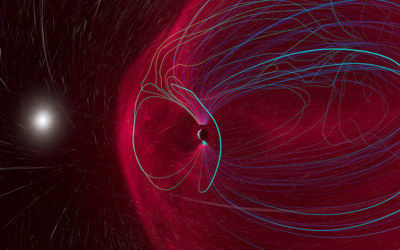

Cosm and U.S. Space & Rocket Center Host Global Domecast for OSIRIS-REx Return

Two days before the capsule’s triumphant return, the INTUITIVE® Planetarium at the U.S. Space & Rocket Center in Huntsville, Ala., collaborated with Cosm to host a live planetarium domecast, “To Bennu and Back: OSIRIS-REx Asteroid Sample Return.” Streamed from...

Cosm announces Premium Media Program offering flexible access to content portfolio

Cosm, a global technology company that builds end-to-end solutions for immersive experiences, has unveiled its new Premium Media Program. Members of the Premium Media Program enjoy regular, exclusive access to an ever-increasing number of immersive films. Over 40...

Cosm Launches Its Premium Media Program To Offer A New & Flexible Approach To Fulldome Programming

Premium Media Program participants receive exclusive access to a growing selection of immersive films on a regular basis, with the option to select three newly added productions by American Museum of Natural History (AMNH), expanding upon 40+ award-winning fulldome...

OSIRIS-REx: Watch party for NASA sample drop at Clark Planetarium

An interpretive image of OSIRIS-REx exploring the surface of Bennu. Credits: NASA/Lockheed MartinSALT LAKE CITY (ABC4) – The asteroid sample capsule of the OSIRIS-REx spacecraft is scheduled to land in the west desert of Utah’s Dugway Proving Ground on Sunday, Sept....

Science Central moves forward on planetarium

Construction on Science Central’s planetarium project is set to begin with a private groundbreaking on Thursday, Sept. 7, which will occur during their annual shutdown from Aug. 28-Sept. 8. The scope of the project will see a 1,830-square-foot planetarium built on the...

Planetarium offers out-of-this-world experience

SIOUX FALLS, S.D. (KELO) — If you were looking to experience the starry sky or the far reaches of space from the comfort of your seat, you used to have to drive to Omaha. But that will soon change when Sioux Falls opens a state-of-the-art planetarium of its own. Since...